For our examples and assessments, the period (n) will almost always be in years. The intersection of the expected payout years (n) and the interest rate (i) is a number called a present value factor. The present value factor is multiplied by the initial investment cost to produce the present value of the expected cash flows (or investment return).

Knowing how to write a PV formula for a specific case, it’s quite easy to tweak it to handle all possible cases. If some argument is not used in a particular calculation, the user will leave that present value of a single sum table cell blank. As shown in the screenshot below, the annuity type does make the difference. With the same term, interest rate and payment amount, the present value for annuity due is higher.

Present Value of a Perpetuity (t → ∞) and Continuous Compounding (m → ∞)

When referring to present value, the lump sum return occurs at the end of a period. A business must determine if this delayed repayment, with interest, is worth the same as, more than, or less than the initial investment cost. If the deferred payment is more than the initial investment, the company would consider an investment. We need to calculate the present value (the value at time period 0) of receiving a single amount of $1,000 in 20 years. The interest rate for discounting the future amount is estimated at 10% per year compounded annually.

- For example, if you had the choice of receiving $12,000 today or in 2 years, you would take the $12,000 today.

- Due to the variety of calculators and spreadsheet applications, we will present the determination of both present and future values using tables.

- Future value considers the initial amount invested, the time period of earnings, and the earnings interest rate in the calculation.

- Given our time frame of five years and a 5% interest rate, we can find the present value of that sum of money.

- There will be times when you will know both the value of the money you have now and how much money you will need to have at some unknown point in the future.

- Where, i is the interest rate per compounding period which equals the annual percentage rate divided by the number compounding periods in one year; and n is the number of compounding periods.

For example, if you had the choice of receiving $12,000 today or in 2 years, you would take the $12,000 today. In order to get the value that you will insert into the formula in the example used in this problem from earlier, we can use the table in the image above. Below is a table for the present value of an annuity of $1 at compound interest.

Visualizing The Length of Time (n)

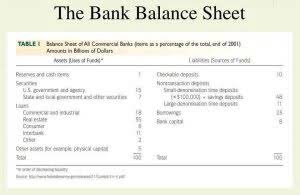

Similar to future value tables, present value tables are based on the mathematical formula used to determine present value. Due to the relationship between future and present values, the present value table is the inverse of the future value table. In present value situations, the interest rate is often called the discount rate. https://www.bookstime.com/ Some individuals refer to present value problems as “discounted present value problems.” Many times in business and life, we want to determine the value today of receiving a specific single amount at some time in the future. A present value of 1 table that employs a standard set of interest rates and time periods appears next.